2018 estimated

tax payment in 2017

Some tax

professionals have contacted the Rhode Island Division of Taxation recently

about making a 2018 estimated tax payment during 2017. (Their inquiries are the

result of tax planning related to proposed federal tax changes now being

weighed by Congress.) In response to these requests, the Division provides the

following information.

Personal income tax

As a convenience for taxpayers who want to

make a 2018 estimated tax payment in 2017, the Division of Taxation has posted

next year’s Form RI-1040ES earlier than it normally would. The 2018 version of

Form RI-1040ES, “Rhode Island Resident and Nonresident Estimated Payment

Coupons,” is available by clicking here.

If you want to make an estimated payment for

2018 – and make it before the end of this month (in other words, before the end

of 2017), fill out the April coupon in the 2018 version of Form RI-1040ES. Send

the completed April 2018 coupon, along with a check or money order, to:

Rhode Island Division of Taxation

One Capitol Hill

Providence, R.I. 02908

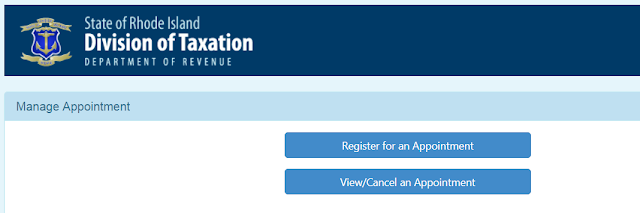

If you prefer to

make an estimated payment of Rhode Island personal income tax for 2018 online,

and make it by the end of 2017, you may pay by credit card or debit card.

First, see the helpful explanation on the Division of Taxation website here. at the following: After that, use the Division’s

credit card/debit card site here. Under “Personal Income Taxes,” click

on “Estimate – 1040ES.” On the next page, be sure to click on “2018” as the filing year.

Trust and estate income tax

As a convenience for trusts and estates that

seek to make a 2018

estimated tax payment during 2017, the Division of

Taxation has posted the 2018 Form RI-1041ES, “Rhode Island Fiduciary Estimated

Payment Coupons,” earlier than it normally would. The 2018 version of Form RI-1041ES is

available here.

If a trust or estate wants to make an estimated

payment for 2018 – and make it before the end of 2017, the entity should mail

the completed April 2018 coupon of Form RI-1041ES, along with a check or money

order, to:

Rhode Island Division of Taxation

One Capitol Hill

Providence, R.I. 02908

Composite filers

Some pass-through

entities, such as partnerships, file composite income tax returns each year on

Form RI-1040C, “Composite Income Tax Return.” The form is typically filed to

report a nonresident owner’s share of Rhode Island source income. The entity

computes the Rhode Island personal income tax and pays it on behalf of the

nonresident partner/owner/shareholder/.

If such an entity wants to make an estimated

payment for 2018 – and make it before the end of 2017, the entity should file

the 2018 version of Form RI-1040C-ES, “Composite Income Tax Estimated Payment.”

The 2018 version is available here. Send the completed 2018 coupon, along with a

check or money order, to:

Rhode Island Division of Taxation

One Capitol Hill

Providence, R.I. 02908